September’s 50 bps Fed rate cut surprised many and was welcomed by virtually all of us (you and me) who are potential residential real estate investors and/or current landlords. In an article earlier this year, I projected two cuts by year-end. Now, I expect the Fed will initiate at least a 25 bps rate cut in November and another in December … followed by four more 25bps cuts through 2025. Good news so far … we’ll see how future Fed moves pan out.

Note: Residential real estate property values are likely to rise with rate reductions … by how much will be driven by amount and frequency of Fed cuts.

Important: Regular readers are familiar with my concept of real estate investor myopia. Simply put, that means a fuzzy vision of the entire residential real estate investment picture when we limit our decision-making to only one economic trigger. Faulty (myopic) perception leads to actions misaligned with reality.

Case in point … too often either inflation or interest rates dominate decision-making by landlords and investors … neither is the sole driver of intelligent planning. So, in this piece I offer three elements to be included in our investment evaluation equation:

- Interest & Inflation Rates

- Wage Inflation

- Employment

Interest Rates & Inflation … the Synergy

Now, I’m going to make a case that inflation is the friend of residential rental investors. We’ll assume SFH rentals for simplicity.

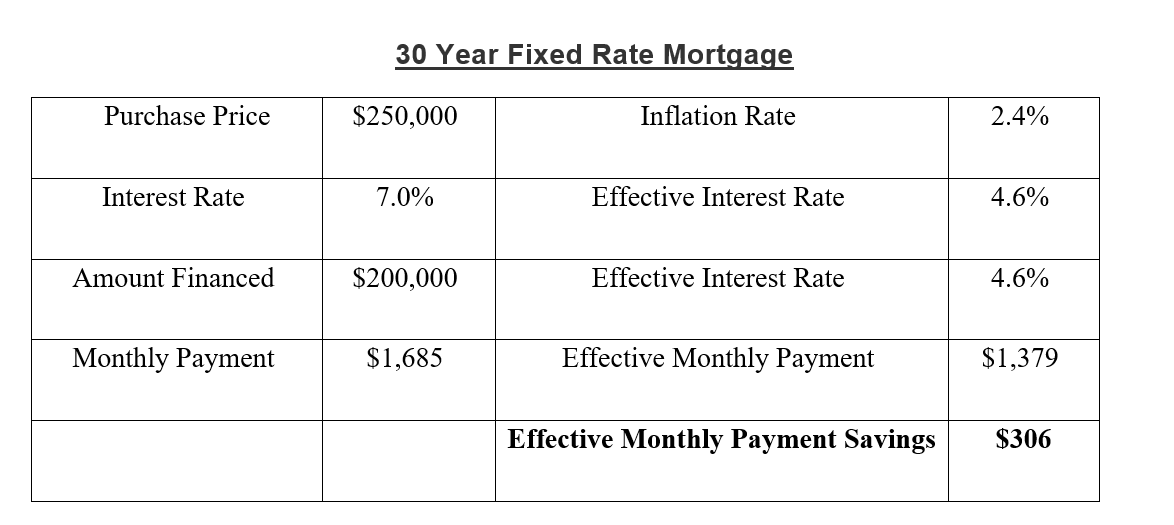

The borrower’s nominal interest rate charged by the lender minus the rate of inflation = real interest rate ... the true cost of borrowing. So, today’s 30-year fixed rate loan of about 7% minus the current rate of inflation of 2.4% means the borrower’s out-of-pocket interest cost is 4.6%.

The true cost of borrowing is critical for evaluating a deal. The point is ... don’t delay investment decision-making in hopes that interest rates tumble to 2022 levels and inflation falls to the Fed’s target of 2% to bail you out.

Lower interest and inflation rates means savings in maintenance and operation expenses.

Uptick in Wage Inflation

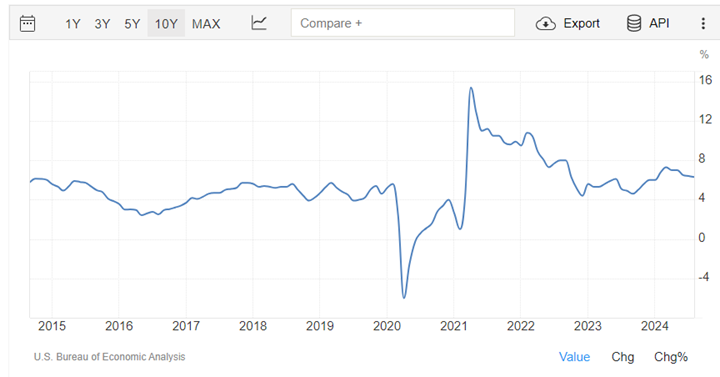

In August 2024, inflation amounted to 2.4 percent, while wages grew by 4.6 percent. The inflation rate has not exceeded the rate of wage growth since January 2023.

This is good news for both renters and residential real estate landlords. Renters, enjoying a bump in purchasing power, are more likely to be motivated to enhance their quality of life by upgrading their housing. Likewise, landlords are positioned to raise rents to increase cash flow and/or invest in needed property improvements.

Employment

Virginia’s unemployment rate has remained stable at 2.8% … with a minor .01 percentage decrease over August of 2023.

Bureau of Labor Statistics, United States Department of Labor

The U.S. Chamber of Commerce tracks labor shortages in all states. Notably, Virginia has only 47 workers available for every 100 open jobs. That bodes well for continued employment boosts in the Commonwealth.

As further evidence, Virginia Works projects employment in Virginia to grow 10.1 percent by 2026 … significantly in excess of the national growth rate of 7.4 percent.

Takeaways

In my view:

- It’s likely the Fed will initiate at least a 25 bps rate cut in November and another in December, followed by four more 25bps cuts through 2025.

- For the balance of this year all seems to be comfortably predictable on the mortgage rate and inflation fronts.

- That said, as fellow investors/risk-takers, we must remain alert to unpredictable events … geopolitical; supply chain delays; economic growth, next month’s election outcome, etc.

As ever, bottom-line comes down to “does the deal make sense?”

given known and anticipated occurrences.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges … and we want to help.