More on this in a bit … but for starters, my decision-making for the balance

of this year is grounded in anticipation of two reductions in rates by the Fed

… 25 basis points no later than September, repeated by year-end.

Regular readers of this newsletter know that I strongly caution all of us as investors to sidestep dwelling on any single economic indicator when it comes to decision-making. The danger is real estate investor myopia … fuzzy vision of current economic triggers.

In addition to my investor instincts expecting Fed rate cuts, there are several other “pieces & parts” to consider … specifically the effect on residential rental properties from wage inflation, leverage, maintenance costs, motivations to buy/sell, cash flow and property valuations. But let’s start with rate cut prospects.

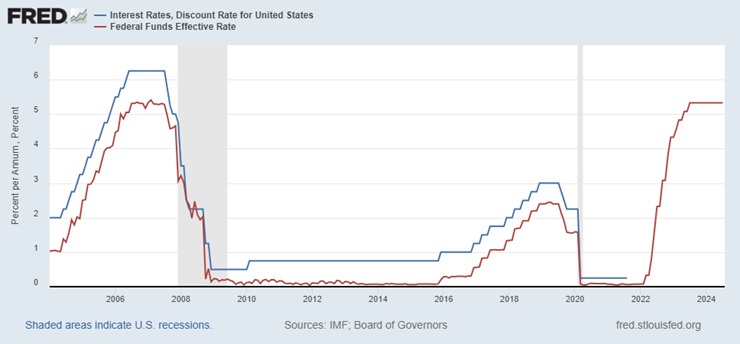

Fed Rate Cuts – Consensus for Q3 & 4 – Historical Effect on Mortgage Rates

As reported by two of several credible financial sources … Forbes magazine and Reuters, the following supports the notion that two rate cuts by year-end are more than just likely. Some quotes:

- "We expect a 25-basis-point reduction in the target range at the September and December FOMC meetings, barring a meaningful upside surprise in the inflation data," wrote Jonathan Pingle, chief U.S. economist at UBS.

- Several members of the policy-setting Federal Open Market Committee (FOMC) expressed "greater confidence" inflation will return to the U.S. central bank's 2% goal without a significant economic slowdown.

- The first interest rate cut may come in September and up to three cuts are possible in 2024. Yet two rate cuts are viewed as most likely, according to this implicit forecast of fixed income markets.

Here’s a Graphic Comparison of the Relationship … Interest Rates/Discount Rate

Click Here for an Interactive Version of the Graph Below

With projected rate cuts as the backdrop, let’s take a look at the potential effects on the following. My comments are not of “crystal-ball-clarity”, just suggestions of elements to consider in your (and my) investment decisions.

- Wage Inflation: American workers are enjoying near optimum employment, increased wages and a willingness to pay higher rents in the face of shrinking inventory for desirable rentals. Additionally, the consensus from one key poll projects that the jobless rate won't rise much from the current 4.1%. A reduction in interest rates on credit cards and other consumer debt may further increase the ability of middle income Americans to afford more “essentials” including rental housing.

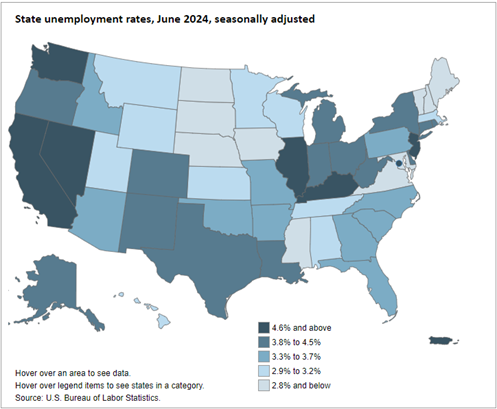

Notably Virginia Unemployment Rate … 2.7 Percent!

Click Here or Image for an Interactive Version of Map Below

Virginia has 47 available workers for every 100 open jobs.

Employers will continue to compete financially for quality workers. That means residential landlords like you and me are likely to experience an expanded tenant pool of workers enjoying sizable bumps in income. Results: Enhanced rental income, tenant quality and appreciation in asset values.

- Prices: The reality is that even as the inflation rate slows, it’s unlikely the cost of many individual items will decline. They just won’t rise as fast. How that may affect maintenance and upkeep outlays for residential landlords remains to be seen. Material costs and tradesmen compensation may remain static or increase based on supply and demand.

- Motivations to Buy/Sell: In a recent article, we made the case to not delay investment decision-making in hopes that interest rates tumble to 2022 levels and inflation falls to the Fed’s target of 2% to bail you out. Yes, lower rates will drive deals especially on properties on the margin of profitability/valuation which may sell for a premium over current valuations. That said, your judgment and mine must be weighed against the true cost of borrowing, maintenance costs, cash flow, financial leverage and property valuation. If values remain static and rates fall, landlords will enjoy enhanced property appraisals, refinance opportunities at less cost and/or a bump in cash flow.

The important thing is “does the deal make sense”?

Takeaways

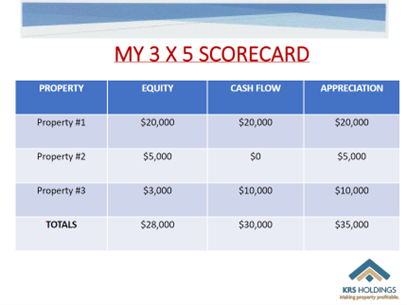

Together, you and I are in the business of wealth creation via investments in residential rental properties. That means taking an intelligent, thought-out approach to evaluating and executing decisions based on a variety of critical factors. As fellow investors/risk-takers, we abhor uncertainty. At least for the balance of this year all seems to be comfortably predictable in the economic outlook, employment and Fed interest rate objectives.

I continue to embrace the primary guiding principle for the balance of this year is ... no apparent headwinds.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help.