PERCEPTION IS REALITY ... THE WAY WE BELIEVE THE WORLD TO BE

- Inflation Stabilized

- Inflation + Interest Rates … Leverage, Synergy, Profits

- What Does Inflation at 2% Mean?

Myopia: When close-up objects look clear but distant objects are blurry.

When it comes to investing, perception has a profound impact on our decision-making. Faulty perception leads to actions misaligned with reality. So, in this third and final article in the series I offer an extended view of a Fed inflation target of 2% as it relates to all of us as residential real estate investors.

In both the first and second articles in this series, I’ve cautioned against focusing on any one economic indicator when it comes to decision-making. My description of the danger is real estate investor myopia. Objective: Avoid fuzzy vision of current economic triggers.

In last month’s issue, we examined the investment synergy of the link between inflation and interest rates. Looking at either ‘I’ in a vacuum fails to present an accurate picture. Now we’ll take a look at the meaning behind and significance (or lack thereof) of achieving and maintaining 2% inflation.

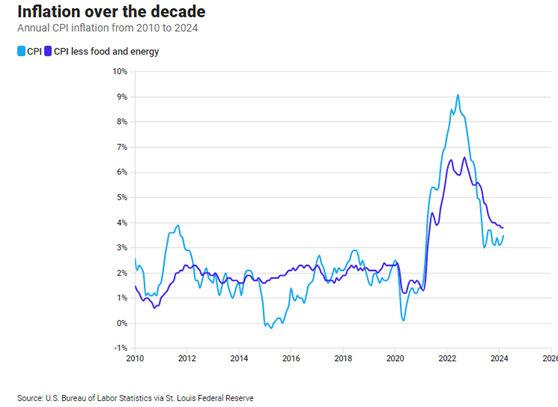

On the topic of inflation, the DOL reports the annual inflation rate for the United States was 3.4% for the 12 months ending May … a slight decrease from 3.5% reported in March. While prices are still rising, the rate of increase is slowing down, which is good news for consumers. As the visual below indicates, while inflation is above the Feds benchmark of 2% it has notably demonstrated little volatility in recent months ... i.e. essentially stabilized.

Fed Myopia?

Consider two elements that trigger Fed decision-making regarding the 2% inflation rate target.

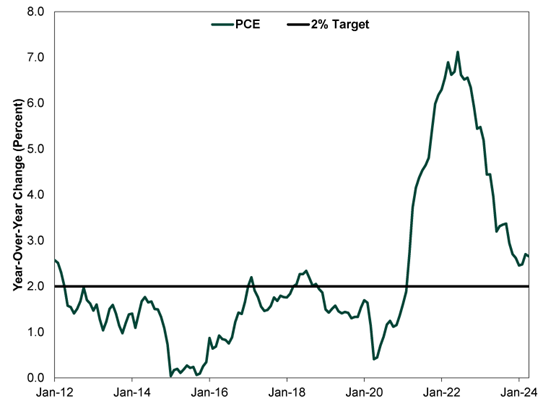

- In its First/Second Quarter 2024 issue of Econ Focus, the Federal Reserve Bank of Richmond offers a history of the decades-long debate … and delay in announcing 2% as the Fed’s target inflation rate. The article summarizes the Federal Open Market Committee (FOMC) position on this issue of monetary policy … "The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run." Apparently, this was a behind-the-scenes target in 1996 … not made public until 2012 – 16 years later.

The Fed made its 2% target official in 2012 and hasn’t had much success hitting it (Exhibit 1).

Exhibit 1: US PCE Since 2012

Source: FactSet, as of 6/3/2024

- Fed economists and advisors maintain reliance on a 65-year-old theory called the Phillips curve. Its basic premise … inflation and unemployment have an inverse relationship; higher inflation is associated with lower unemployment and vice versa. In a recent Washington Examiner article, my conviction regarding the Phillips curve is echoed, “The Phillips curve positing a trade-off between unemployment and inflation is a false dichotomy…” Increased wages and employment gains are not drivers of inflation. Inflation drives rising pay … not the reverse.

So, is the Fed’s field of vision atrophied by only two determining factors … employment and inflation?

In Contrast:

- The Bureau of Labor Statistics said that a net 272,000 new jobs were created in May, up from the downwardly revised total of 155,000 recorded in April and firmly ahead of this year's average of around 245,000. Economists were looking for a headline total of 185,000 in the May report.

- Over-the-Year Unemployment Rates Decreased in Most of Virginia’s Counties1 and Metropolitan Statistical Areas; Also, true nationally

- The inflation rate is stabilized and slightly lower.

- Average hourly earnings jumped to 4.1% from April’s level of 3.9%.

- While prices are still rising, the rate of increase is slowing down

- Federal Reserve Chair Jerome Powell said that the central bank is unlikely to raise its key interest rate – a hint at a future cut - and underscored his view that price increases would soon start to cool again.

Takeaways

I’m sticking to my guns! I continue to embrace the primary guiding principle for the balance of this year is ... no apparent headwinds.

Additionally, American workers are enjoying near optimum employment, increased wages and a willingness to pay higher rents in the face of shrinking inventory for desirable rentals. All signs point to a continued healthy economy and GDP growth during 2024 and perhaps beyond.

As fellow investors/risk-takers, we abhor uncertainty. At least for the balance of this year all seems to be comfortably predictable.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management options

plus maximize your rental property return on investment.