Two Reasons and Two Virginia Markets to Invest in Single-Family Residential Rentals

Trend-watchers … be aware of the growing interest by both renters and investors in the single-family residential rental market. Periods of major change are often periods of superior opportunities … in this case for both seasoned and wannabe residential rental investors. In this article, we’ll take a look at the national trends and then bring it closer to home here in Central Virginia.

Reason 1: Growth of the Single-Family Rental (SFR) Market – Renters Perspective

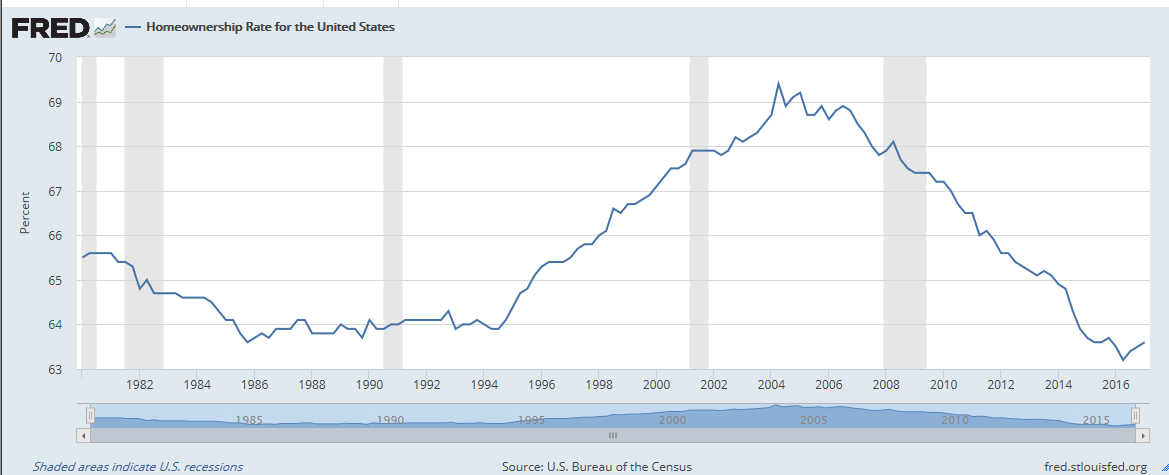

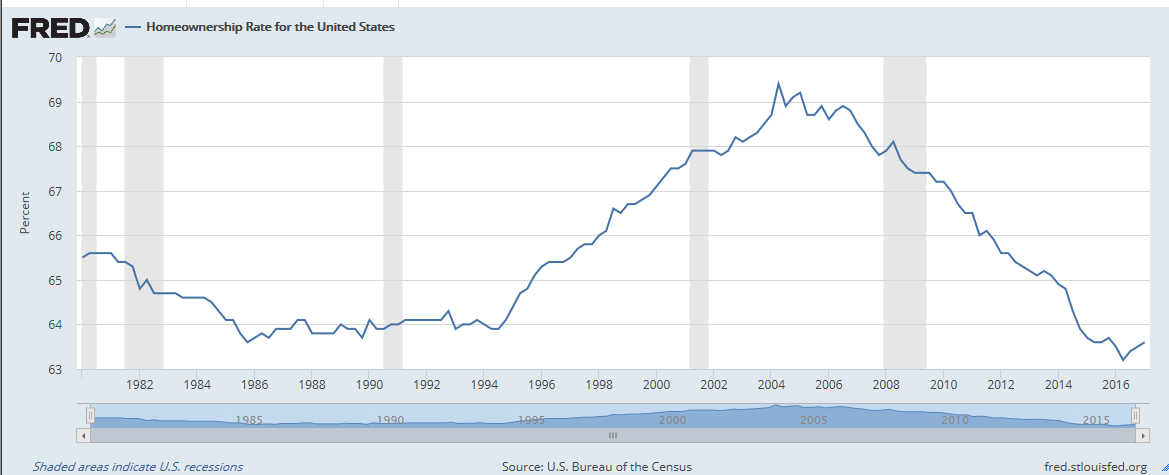

The home ownership rate has eroded to a level not seen in over 50 years. U.S. home ownership peaked at 69 percent in 2004 and suffered its decline to just 63.4 percent at the end of last year … the lowest since 1966. This drop in homeownership helps fuel the current booming SFR market, as each percentage point represents about one million households. Admittedly, the 2004 homeownership peak was inflated by easy mortgage credit and borrower qualification requirements. Those days are long gone which creates a pool of former homeowners who are likely to remain renters now and for the foreseeable future. In a Joint Center for Housing Studies (JCHS) at Harvard University the conclusion reveals a shifting configuration of the housing market to an increasing demand for rentals. And this development cuts across nearly every age and income demographic.  Clearly, renting has become more of an accepted choice of lifestyle today. As rent growth flattens and home prices continue to escalate, renting is more and more the preferred housing choice for the first time in many years. Baby boomers seeking to sell their homes, now see an SFR as an excellent way to downsize … meaning leaving homeownership, but not single-family living. Millennials, the largest generation in the U.S., cannot be ignored as a major factor in the mix of potential renters. As they begin to set up households and raise a family, SFRs will be increasingly in demand. Often burdened by student debt, many millennials are not in a position to buy a home, but will welcome the privacy of an SFR. Currently, reports are that roughly one-third of American households rent … and about one-third of those rentals are single-family homes. Certainly, given the above developments and trends, it is very likely that more and more renters will seek the housing option of an SFR.

Clearly, renting has become more of an accepted choice of lifestyle today. As rent growth flattens and home prices continue to escalate, renting is more and more the preferred housing choice for the first time in many years. Baby boomers seeking to sell their homes, now see an SFR as an excellent way to downsize … meaning leaving homeownership, but not single-family living. Millennials, the largest generation in the U.S., cannot be ignored as a major factor in the mix of potential renters. As they begin to set up households and raise a family, SFRs will be increasingly in demand. Often burdened by student debt, many millennials are not in a position to buy a home, but will welcome the privacy of an SFR. Currently, reports are that roughly one-third of American households rent … and about one-third of those rentals are single-family homes. Certainly, given the above developments and trends, it is very likely that more and more renters will seek the housing option of an SFR.

Reason 2: The Single Family Rental (SFR) Market – Investors Perspective

All of the above addresses the SFR market from the perspective of renters. Now let’s look at it from the other side of the SFR equation … landlords. In general, the best investment property for beginners is a residential, single-family dwelling. Single-family homes tend to attract longer-term renters and typically superior tenants that make rental payments on time and take better care of the property. Likewise, these same plusses are drivers for seasoned residential rental investors as well. Additionally, turnover is typically lower than with apartments, landlords don’t have common-area maintenance costs and the asset’s value has meaningful upside compared to apartments. The growth of the SFR market continues despite the prospect for projected interest rate hikes. According to the Mortgage Bankers Association, the forecast for the 30-year mortgage rate will hit 4.7 percent by the end of this year, rise to 5 percent by the Q3 of next and 5.5 percent by year-end 2019. Given historical highs in interest rates, these levels don’t appear to dampen investors’ appetites for SFR opportunities. Home values are still below their peak in many areas pointing to the potential for added SFR appreciation on the horizon. According to Attom Data Solutions surveys, fundamentals remain strong. The average annual gross rental yield was 9 percent for the first quarter of 2017, down slightly from 9.1 percent during the same period in 2016. In addition, average fair-market rents increased in 2017 86 percent in the 375 markets Attom analyzed, while average wage growth outpaced rent growth in 67 percent of those markets, creating what Attom calls a recipe for sustainable growth in the rental market. This is great news for investors who want to continue to expand their single-family rental portfolios or for new investors to enter the rental market.

Two Central Virginia Markets – Greater Richmond & Tidewater

There are bargains out there for single family residences. So, for residential rental investors in Central Virginia, it may be an excellent time to expand your investment horizons or maybe put your toe in the water as a first-time landlord. Curious? Overwhelmed? Or just want more information? Contact a Richmond property management company.

Greater Richmond Here’s a timely bit of investor intelligence regarding SFR opportunities in Greater Richmond. Realty Trac took a look at high-yield single family rental markets that are hidden gems - undiscovered by the big institutional investors who have dominated some markets, pushing up prices and compressing yields in those markets. The survey included 473 counties nationally and then condensed down to 28 final contenders … one of which is Richmond City! There are additional unique developments in the Greater Richmond market that benefits alert SRF investors. Shortage of Blue Collar SFRs: As residential real estate prices have slowly but certainly come back to life since the 2006 slump, landlords are selling SFRs to realize long delayed profits. Those sales typically result in the properties becoming owner occupied. That means that existing renters, particularly those not credit-worthy or unable financially to buy, become displaced and must seek alternative housing. Investor Opportunity: You can get good tenants if you can provide affordable housing. Many (most?) of these displaced tenants have good histories of making rental payments on time and taking care of the property. That means investors may be able to replace tenants of less quality from a growing pool of quality renters.Rental Inflation is a Fact of Life: As demand by renters increase, so will rents. Investor Opportunity: Now is an excellent time to lock in good tenants with a 2 or 3 year lease. That is attractive to renters who then know their budget expectations for an extended period of months. Likewise, investors win with a more profitable cash-flow and assurance of reduced tenant turnover and potential vacancies.

Tidewater In contrast, the Tidewater Region population footprint boasts of 3 million residents vs. a million in Greater Richmond. That means more SFRs needed to satisfy rising renter demand. Here are several characteristics of the Tidewater Region that SFR investors will find valuable.

- There are excellent opportunities for alert investors to purchase single family properties in the Tidewater Region. There are bargains out there, particularly in solid neighborhoods with purchase prices in the $100,000 to $150,000 range. Many landlords are profiting from purchasing reasonably priced properties in the “fixer-upper” category. An investment of $10,000 - $20,000 in upgrades will showcase an attractive rental housing product which, in turn, will attract good tenants.

- The Region is host to a heavy concentration of military personnel. While this is a “revolving door” of prospective tenants, there are two major benefits for landlords. First, military renters tend to be better disciplined and are more likely to respect and maintain the SFR. Second, rents may be collected via payroll allotments which better ensures prompt payments.

- The Region is largely blue collar in terms of workforce. This tends to result in longer term tenants.

Summary Residential property values continue to appreciate, rents are on the rise, demand on the part of Millennials for quality rentals grows and interest rates are in the cellar for at least a while more. What’s not to like for first-time investors as well as veteran landlords? Certainly a time for careful consideration of opportunities that may not be seen again for many years … if ever.